Trading Idea: US30 Set for Bullish Continuation

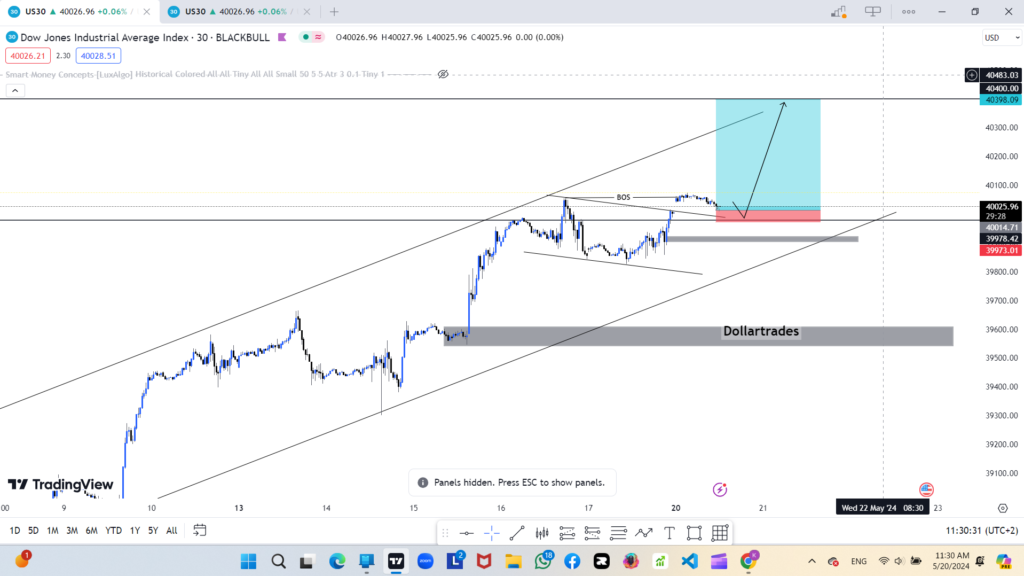

The Dow Jones Industrial Average (US30) has been demonstrating a consistent upward trajectory, and recent chart analysis suggests a potential for further bullish movement. Based on the provided technical chart, let’s break down the trade idea and key levels to watch for in the coming sessions.

Current Trend and Market Structure

The US30 is currently retesting a bullish flag pattern, indicating a strong bullish trend. The price action has been respecting support and breaking resistance levels as it moves higher.

Break of Structure (BOS)

A notable feature on the chart is the Break of Structure (BOS) around the 40000 level, signifying a bullish shift. This break indicates that the bulls have gained control, potentially leading to further upward momentum. The BOS acts as a key confirmation for the bullish bias.

Key Levels to Watch

- Support Zone: The immediate support zone is highlighted in the red and blue shaded area around the 40014.71 to 39978.42 levels. This zone aligns with the lower boundary of the ascending channel and is a crucial area to watch. A pullback to this zone could present a buying opportunity, as the price is likely to find support here before resuming its upward movement.

- Resistance Levels: The key resistance levels to monitor are at 40398.09 and 40483.03. These levels are potential targets for the bulls if the price manages to bounce off the support zone.

- Demand Zone: A strong demand zone is identified between 39500 and 39700, which coincides with the lower region of the channel and previous consolidation area. This zone provides a significant support level if the price experiences a deeper pullback.

Trade Strategy

Given the current market structure and key levels identified, the trade strategy involves waiting for a potential pullback to the support zone around 40014.71 to 39978.42. Traders can look for bullish reversal signals in this area, such as bullish candlestick patterns or confirmation from momentum indicators, to enter long positions.

Target Levels

- Initial target: 40200

- Extended target: 40400

Risk Management

- Stop Loss: Below the 39973.01 level, to account for potential volatility and to protect against a deeper pullback beyond the support zone.

- Risk-to-Reward Ratio: Aim for a favorable risk-to-reward ratio of at least 1:3, ensuring that the potential reward justifies the risk taken.

SIGNAL

- Buy US30

- SL 39960

- TP1 40200+200 pips

- TP2 40400+400 PIPS

Conclusion

The US30 appears poised for further gains, supported by the ascending channel and recent Break of Structure. By carefully monitoring the key support zone and waiting for confirmation of a bullish reversal, traders can capitalize on the potential continuation of the upward trend. As always, adhering to proper risk management practices is essential to mitigate potential losses and maximize gains.

Youtube:

https://youtu.be/FKuUdtHJr_A